It was a year that defied expectations by many accounts. A number of forecasts predicted that the US economy would enter a recession in 2023 as the Federal Reserve raised interest rates to fight high inflation. But the economy remained resilient, inflation eased, and the Fed declined to lift rates later in the year. US stocks rose in 2023, despite some setbacks along the wayi. Many economists who called for a recession have since walked back their predictions. This underscored that guessing where markets may be headed is not a reliable way to invest.

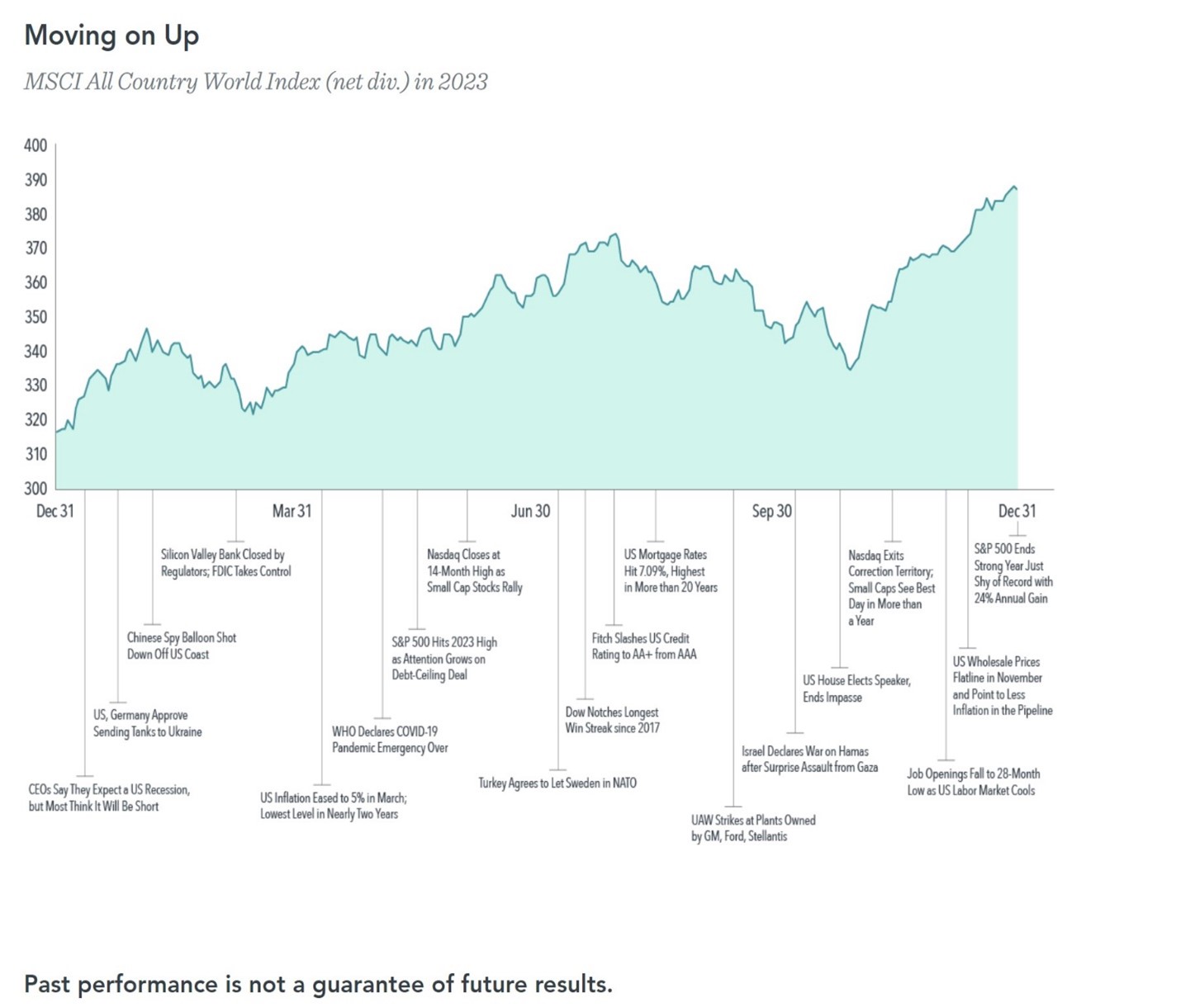

A year that many speculated would be lackluster for US stocks saw the S&P 500 post gains of 26.3% on a total-return basis, extending a bull-market rally that began in 2022.ii Global stock markets also bounced back after posting their worst year since the financial crisis. Equities, as measured by the MSCI All Country World Index, rose 22.2% even as geopolitical tensions increased, with war continuing in Ukraine and hostilities erupting in the Middle East (see Below).iii Developed international stocks, as represented by the MSCI World ex USA Index, added 17.9%, while emerging markets notched smaller gains, with the MSCI Emerging Markets Index up only 9.8%.iv

v

Big Boost from Big Tech

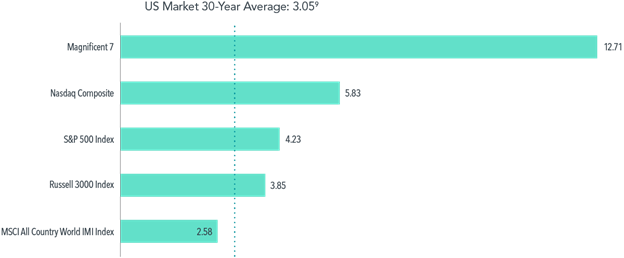

Among the strongest performers in 2023 were technology stocks, recovering after a poor showing in 2022. The tech-heavy Nasdaq rose 44.6%.vi Much of the stock market’s gains can be attributed to just a handful of companies, recently dubbed the Magnificent 7.vii They were led by NVIDIA amid strong sales of its computer chips, as interest in artificial intelligence built. However, valuations for those seven stocks remain high, with an aggregate price-to-book (P/B) ratio of 12.71. This helped push up the Nasdaq’s P/B ratio to 5.83. Some other prominent indices have substantially lower valuations. For example, the MSCI All Country World IMI Index’s P/B ratio is less than half that of the Nasdaq’s (see Below). While high valuations may concern equity investors, they can result from a subset of companies. Investors should be careful not to paint all stocks with the same brush.

viii

Magnificent 7 outperformance might be difficult to sustain; past gains don’t guarantee future ones. Rather than seeking additional exposure to these mega cap stocks, investors may be better off ensuring their portfolios are broadly diversified, positioned to capture the returns of whatever companies may rise to the top in the future.

In the bond market, US Treasuries rebounded after posting their worst annual return in decades in 2022, with the Bloomberg US Treasury Bond Index gaining 4.1% vs. the previous year’s 12.5% decline.ix But it was not a smooth ride for investors. Despite rising bond prices generally, yields (which fall when prices rise) were higher than they have been for most of the past decade. The 10-year Treasury yield nearly touched 5% in October for the first time since 2007, before pulling back below 4% by year-end.x For the entire year, the 10-year yield was lower than that of three-month bills, keeping the yield curve inverted. While many investors see yield curve inversion as a foreboding signal of a recession or stock market downturn, data from the US and other major economies show yield curve inversions have not historically predicted stock downturns consistently. And no US recession was declared in 2023.

What’s in Store for ’24?

Economic resilience in the US and elsewhere is helping boost the global outlook for 2024, but as investors learned last year, the only thing certain is that there will be plenty of uncertainties. Many variables are in play for markets this year, from wars in Ukraine and the Middle East to questions around interest rates. Investors are also likely to be closely following the upcoming presidential election in the US. But it’s worth noting that the political party that wins the White House is just one of many factors investors consider when pricing assets, and stocks have generally trended upward regardless of which party holds the presidency. This may be reassuring when one considers the difficulty, or perhaps futility, of trying to guess what is going to happen in 2024—or any year. That’s why it’s recommended that investors plan for what might happen rather than predict what will. Last year was a vivid example of why such advice is prudent.

*The views and opinions expressed in this article may not necessarily reflect those of IPC Securities Corporation.

i Based on the 2023 calendar-year return of the Russell 3000 Index, which rose 26.0%.

ii S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

iii MSCI data © MSCI 2024, all rights reserved.

iv Based on the 2023 calendar-year returns of S&P and MSCI indices.

v In USD. MSCI All Country World Index, net dividends. MSCI data © MSCI 2024, all rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Headlines are sourced from various publicly available news outlets and are provided for context, not to explain the market's behavior.

vi Based on the 2023 calendar-year return of the Nasdaq Composite Index. © 2024 Nasdaq Inc. All rights reserved. Returns are calculated from the total return index values.

vii The Magnificent 7 stocks include Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

viii Indices are not available for direct investment. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © 2024, all rights reserved.

ix Based on the 2023 calendar-year return of the Bloomberg US Treasury Bond Index. Bloomberg data provided by Bloomberg Finance LP.

x Source: US Treasury.

xi Eugene F. Fama and Kenneth R. French, “Inverted Yield Curves and Expected Stock Returns” (white paper, 2019).