Charlie Munger’s Enduring Wisdom

William Barreca - Dec 11, 2023

Charlie Munger, Warren Buffett’s business partner, passed away at 99.

His wisdom and principles have significantly shaped my approach to business, investing and life.

I was lucky enough to listen to him and Warren live at the 2019 Berkshire Hathaway annual meeting. Even into his 90s, Charlie displayed unparalleled insight.

More so than being a great investor, when Charlie was asked how he wanted to be remembered, he said he hoped he’d be remembered as a teacher.

I wanted to share some of my favorite quotes from Charlie and lessons I’ve learned.

1. Good investing is simple

“It’s remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

Good investing doesn’t require complexity or constantly making genius decisions.

Yet, investors often overcomplicate their investments or constantly try to hit homerun's. More often than not, it results in a worse outcome.

For most people, good investing means investing in a low-cost, globally diversified portfolio, matching your risk tolerance and risk capacity, and then not doing anything else.

It’s not more complicated than that.

Individual stock picking, trend-chasing, and market timing are all examples of ways investors overcomplicate things, usually to their detriment.

Warren Buffett is famous for saying:

“I don’t look to jump over 7-foot bars: I look around for 1-foot bars that I can step over.”

2. Beware of charlatans

“I try to get rid of people who always confidently answer questions about which they don’t have any real knowledge.”

Both traditional and social media are filled with people confidently pontificating on things that they have no knowledge about.

This ranges from television personalities like Jim Cramer, to advice found on platforms like TikTok and Reddit.

Jim Cramer spends all day talking about stock picks. In a single year, he’ll likely talk about thousands of stocks. There’s no way he has the time in his life to do the research and analysis on every one of those required to provide an educated opinion on them.

Meanwhile, social media is filled with people with no credentials and no liability, providing advice on things they largely know little about.

It’s all noise, and investors would be better to tune it out.

3. Patience is one of the best traits an investor can have

“The big money is not made in buying and selling, but in the waiting”

Charlie sums it up perfectly here, but it’s counterintuitive to how many people think about investing.

It’s natural to think this. In almost every other fact of life, motion is good. We’re taught that to make progress, you must be doing something.

That’s not the case in investing. If you already have a solid portfolio designed to reach your goals, you should rarely, if ever, touch it.

This is especially true during market volatility, where investors are most vulnerable and make emotional decisions like trend chasing or going to cash.

4. Don’t overspend your income and always be saving

“Spend less than you make; always be saving something. Put it into a tax-deferred account. Over time, it will begin to amount to something. THIS IS SUCH A NO BRAINER”

Charlie suggests prioritizing saving.

More commonly, people do the opposite. They spend first and save if anything is left over. There’s usually little, if anything, left to save.

People might be discouraged by the amount they can save, particularly in their early earning years.

Don’t be discouraged. Little amounts and a lot of patience can amount to a lot in the future.

5. Stock market volatility is normal

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century you’re not fit to be a common shareholder, and you deserve the mediocre result you’re going to get compared to the people who can be more philosophical about these market fluctuations.”

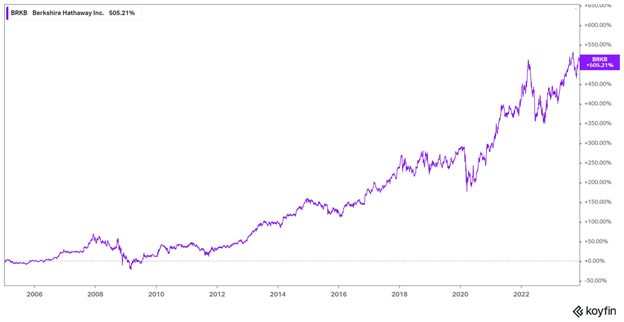

Charlie said this in 2009, in response to a question about whether he was concerned that Berkshire Hathaway shares, which comprised most of his net worth, had dropped more than 50% after the Financial Crisis.

During market volatility, it’s natural to get caught up and be tempted to make irrational choices.

It’s important to remember that market volatility is normal, and will always occur with some regularity.

Here’s a chart showing Berkshire Hathaway’s stock price. That 50% decline? If you zoom out enough, it’s barely noticeable.

The volatility of stock markets is the price you pay for the higher expected return of stocks versus other assets like cash or bonds.

*The views and opinions expressed in this article may not necessarily reflect those of IPC Securities Corporation.