AI & The Risks of Investing in the Newest Trends

William Barreca - Jul 20, 2023

AI has emerged as the latest trend with the potential to transform our lives.

It has also captured the attention of investors hoping to capitalize on the next big thing.

Will that work out for them?

It could. Or maybe not.

New industries are inherently unpredictable.

There are already serious deliberations on what sort of regulations will be placed on the industry. At this point, it's unknown what those regulations will be or what impact they will have on the industry's commercial viability.

Setting regulatory concerns aside, even assuming a favorable regulatory environment, accurately predicting the emergent leaders in AI is no easy task. History has shown us that in the early stages of new industries, many companies vie for dominance, but only a select few emerge as true winners.

In the early 1900s, cars were the next big thing.

In 1908, there were 253 car manufacturers in the US.i By 1929, this number dropped to 44 manufacturers.

Only 3 of those (Ford, GM & Chrysler) exist today. Picking the winner out of the 253 car companies would've been extremely difficult.

Another risk for new industries is not knowing how the economics would work.

No matter how much AI changes the world, this doesn't mean it will be a successful business.

There's a difference between the value a company/industry can create for the world and a company's ability to capture that value in terms of profit.

Look at the airlines as an example of an industry that has undoubtedly changed the world. Despite this, airlines have primarily been a disaster of an investment with a long history of companies going bankrupt, defunct, or requiring government bailouts to survive.

Since 1978, there have been over 100 bankruptcy filings for airlines in the USii.

More recently, you can look at Spotify.

Spotify changed the way the world listens to music. In their last earnings call, Spotify reported having over 515 million monthly active users.

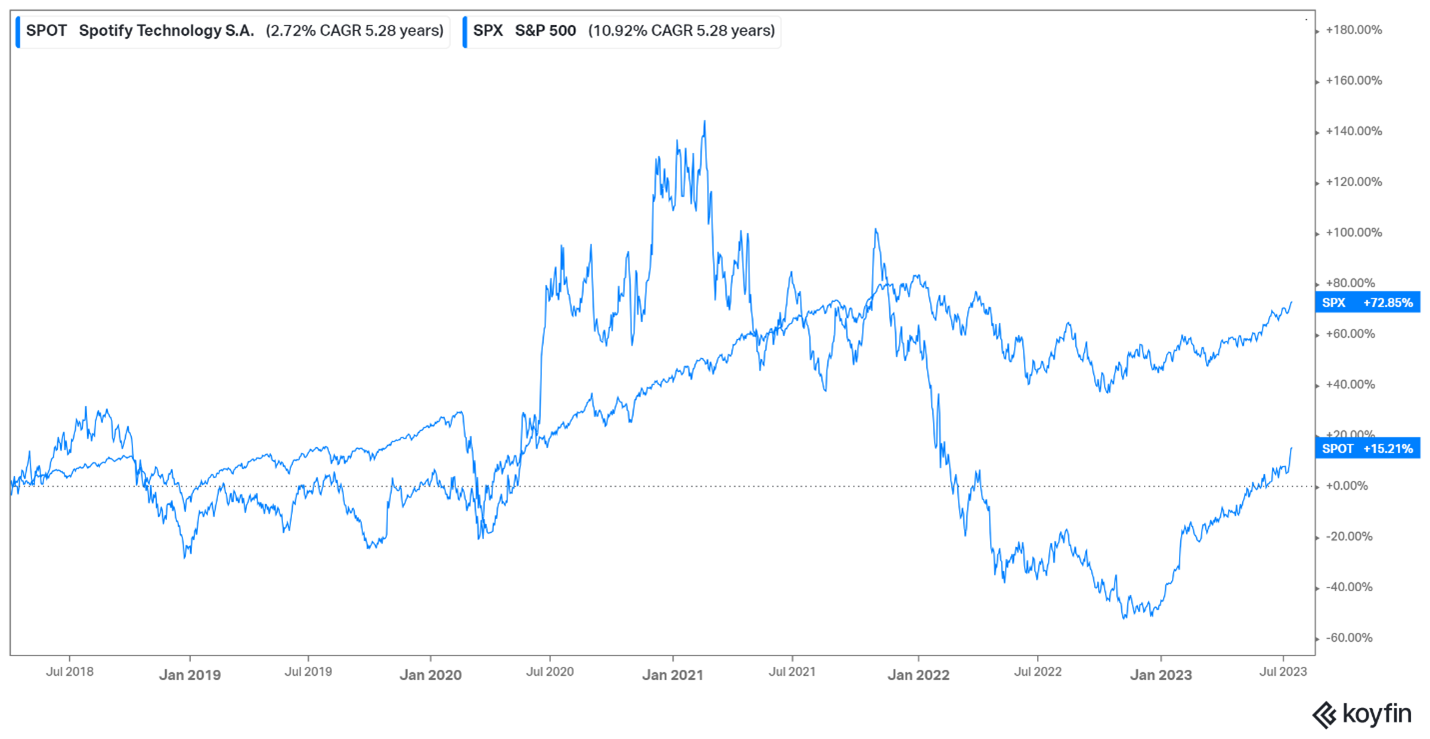

Despite how much Spotify has changed the world and created user value, it's been a mediocre investment.

Since its IPO in April 2018, Spotify has only returned 15%, significantly lagging the S&P 500.

This isn't to say that AI companies are guaranteed to be a bad investment.

It's just that industries in their early stages are challenging to predict. Lots of money has been lost blindly betting on the next big thing, and you should know the risks involved.

The views and opinions expressed in this article may not necessarily reflect those of IPC Securities Corporation.

i https://www.history.com/topics/inventions/automobiles

iihttps://www.airlines.org/dataset/u-s-bankruptcies-and-services-cessations/