4 Common Investment Misconceptions

William Barreca - Jul 17, 2023

1. You Should Always Buy the Dip

Buying the dip is buying more of an asset during declines. The theory goes that the asset will eventually recover to previous price levels.

The problem is that sometimes individual stocks go into draw downs and never recover to their previous levels. In extreme cases, they can go all the way to zero.

There are too many examples to count, but Citigroup and Blackberry are two examples of stocks that haven’t recovered to their previous all-time highs.

More diversified portfolios, or index funds, are different. Individual companies are never guaranteed to bounce back, but it would take a calamity for something like the Toronto Stock Exchange not to recover from a downturn.

This doesn’t mean you should hold cash and wait for a dip in stock markets to deploy the cash.

This is market timing, which isn’t a reliable strategy.

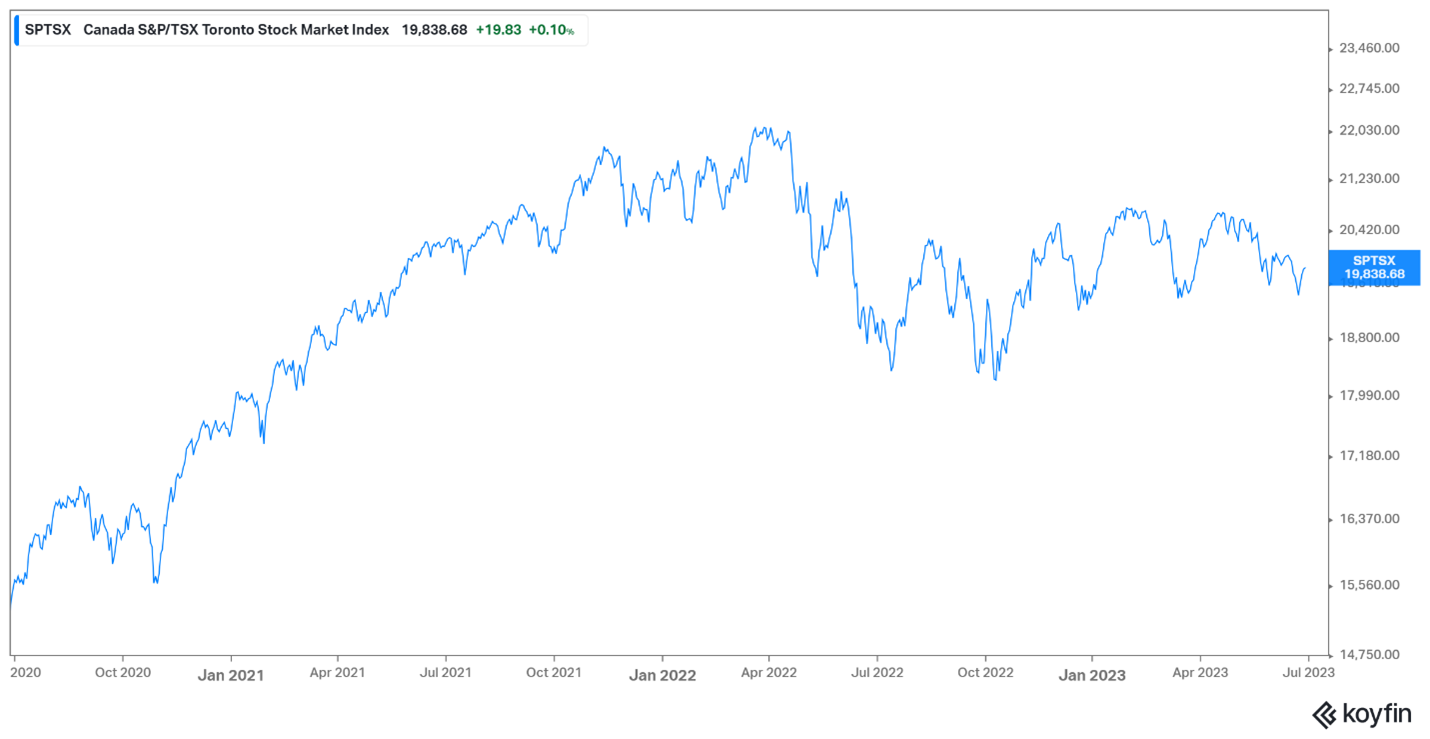

For example, if at the end of 2021, you’d thought that we were due for a correction, and held some cash because you thought we were due for a correction, here’s what happened:

We got a correction, but even if you could perfectly time the bottom in 2022, you were still buying at levels you could’ve in 2021.

Use a systematic approach like dollar cost averaging to take these tough decisions out of the equation.

2. New Market Highs Means A Crash Is Coming

The media has a narrative that stock market highs are scary because it must mean we’re in a bubble and a crash is imminent.

New stock market highs are completely normal.

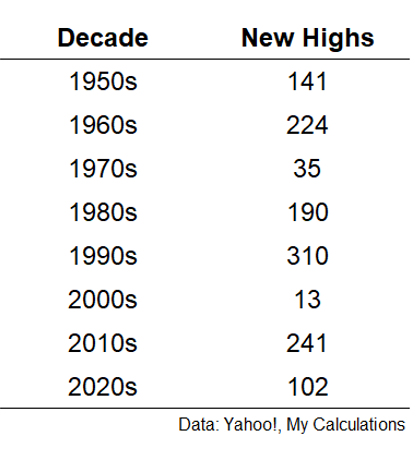

Credit to Ben Carlson from Ritholtz Wealth Management for this data:

Ben also points out that over the last 100 years or so, 1 out of every 20 days the market has been open has closed at an all-time high.

3. Diversification is Bad

Diversification is the closest thing to a free lunch in investing.

The collapse of First Republic Bank is a harsh reminder that any stock can go to zero. It was previously considered a rock-solid regional bank.

First Republic had been in the S&P 500 since 2018. On the day JP Morgan announced it was taking over the bank, the S&P 500 dropped .039%.i

It’s safe to assume, outside of a nuclear war, the stock market won’t go to zero. The same can’t be said of any individual stock.

This is why diversification is your friend.

4. Dividends Are A Good Investment Strategy

Dividends aren’t inherently bad, but you shouldn’t build a portfolio by focusing on big dividend payers.

Dividends are a form of mental accounting. It feels good when the cash hits your account, but they aren’t magical.

Investment returns come from a combination of share appreciation and any dividends the corporation pays.

You should be agnostic about where your returns come from. The only thing that matters at the end of the day is your total return, whatever form that takes.

Exclusively focusing on dividends would have caused you to miss out on some of the top performing stocks of the last decade like Amazon, Netflix and Tesla.

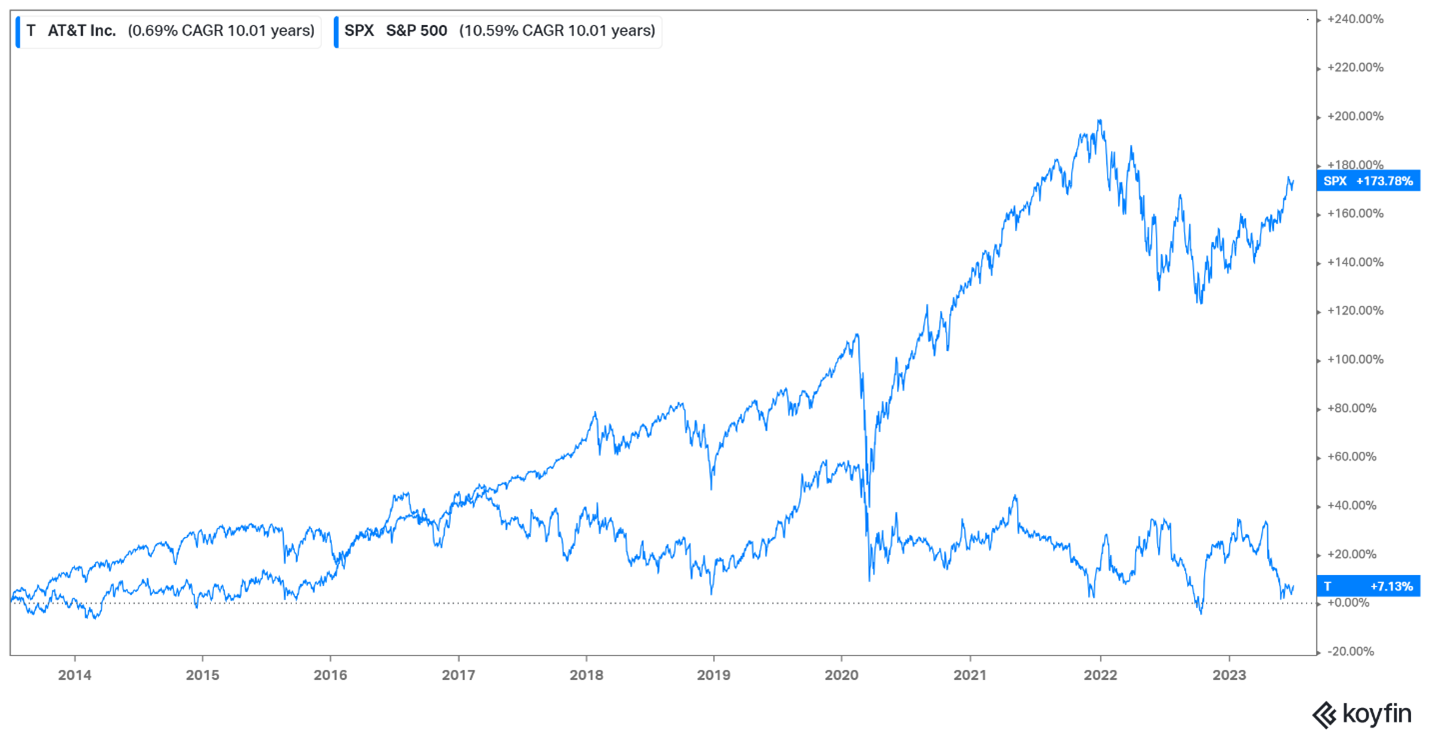

Dividend payers also don’t guarantee good performance. Over the last 10 years, AT&T has averaged about a 6% dividend.

However, the share price has barely moved, and as a result it’s only earned 7% including the dividends.

The views and opinions expressed in this article may not necessarily reflect those of IPC Securities Corporation

i https://www.dimensional.com/ca-en/insights/the-stock-market-vs-stocks-in-the-market