Why You Think Twice About Getting Your Financial Advice From Social Media

William Barreca - Jun 26, 2023

The rise of the internet and social media has made information more accessible than ever before. While this has its advantages, it has also created a concerning trend. With just a social media account and some savvy, anyone can share information and gain a large following.

The problem with this is that much of this information is factually incorrect and can be harmful to the audience.

Regarding investing & financial planning, there is a significant trend of people taking financial advice from people who are either in no way qualified to give financial advice, have questionable motives, or a combination of both.

A recent paper from the Swiss Finance Institute studied this by tracking over 29,000 “finfluencers”.

The study found that the majority (56%) of finfluencers were anti-skilled, meaning that following their investment advice yielded a monthly alpha of -2.3%1.

Further, the study found that “finfluencers who provided the worst advice were the most active and had the greatest following.”

How can that be possible? The paper states, “Anti-skilled finfluencers ride return and social sentiment momentum, which coincide with the behavioral biases of retail investors who trade on anti-skilled finfluencers’ flawed advice.”

Basically, people read and listen to what they want to hear.

Boring but effective strategies like index-funds, a steady savings rate, and long-term compounding aren’t exciting. So, people who purvey that type of advice don’t get that much relative attention.

On the other hand, speculation and get rich-quick schemes is a highly compelling message. Who doesn’t want quick, easy money?

For example, during the pandemic, Dave Portnoy of Barstool Sports started a day trading show, and became a meme stock personality.

1https://www.advisor.ca/my-practice/investors-flock-to-loudest-least-skilled-voices-on-social-media-finds-research/#:~:text=Investment%20advice%20has%20become%20easier,bet%20against%20the%20loudest%20finfluencers.

As stock markets boomed in 2020 & 2021, he gained a massive following by encouraging people to act in highly dangerous activities like day trading and gambling on highly speculative stocks.

He made statements like “Anybody can do this game.” and pronounced himself the captain of stocks and Warren Buffett, “washed up.”

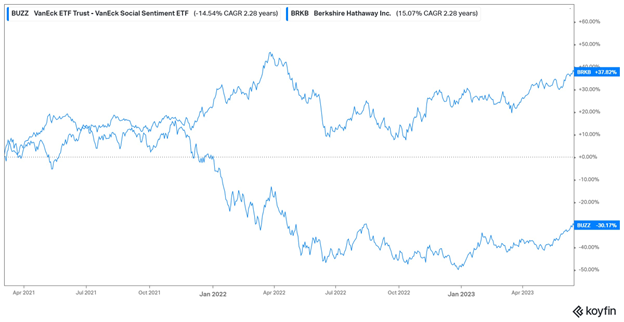

In 2021, Portnoy launched the VanEck Vectors Social Sentiment ETF. Since it came out, the ETF is down -30%, while Buffett’s company, Berkshire Hathaway, is up 37%.

Thankfully, as the meme stock craze crashed, Portnoy has returned to reviewing pizzerias, which is much less destructive than his investment advice.

When searching for financial advice, seek out qualified advice. Individuals can make more informed decisions by prioritizing reliable sources and seeking qualified advice.

The views and opinions expressed in this article may not necessarily reflect those of IPC Securities Corporation.