Demystifying Group RRSP & DCPP Investments: A Guide to Choosing the Right Investment for You

William Barreca - May 02, 2023

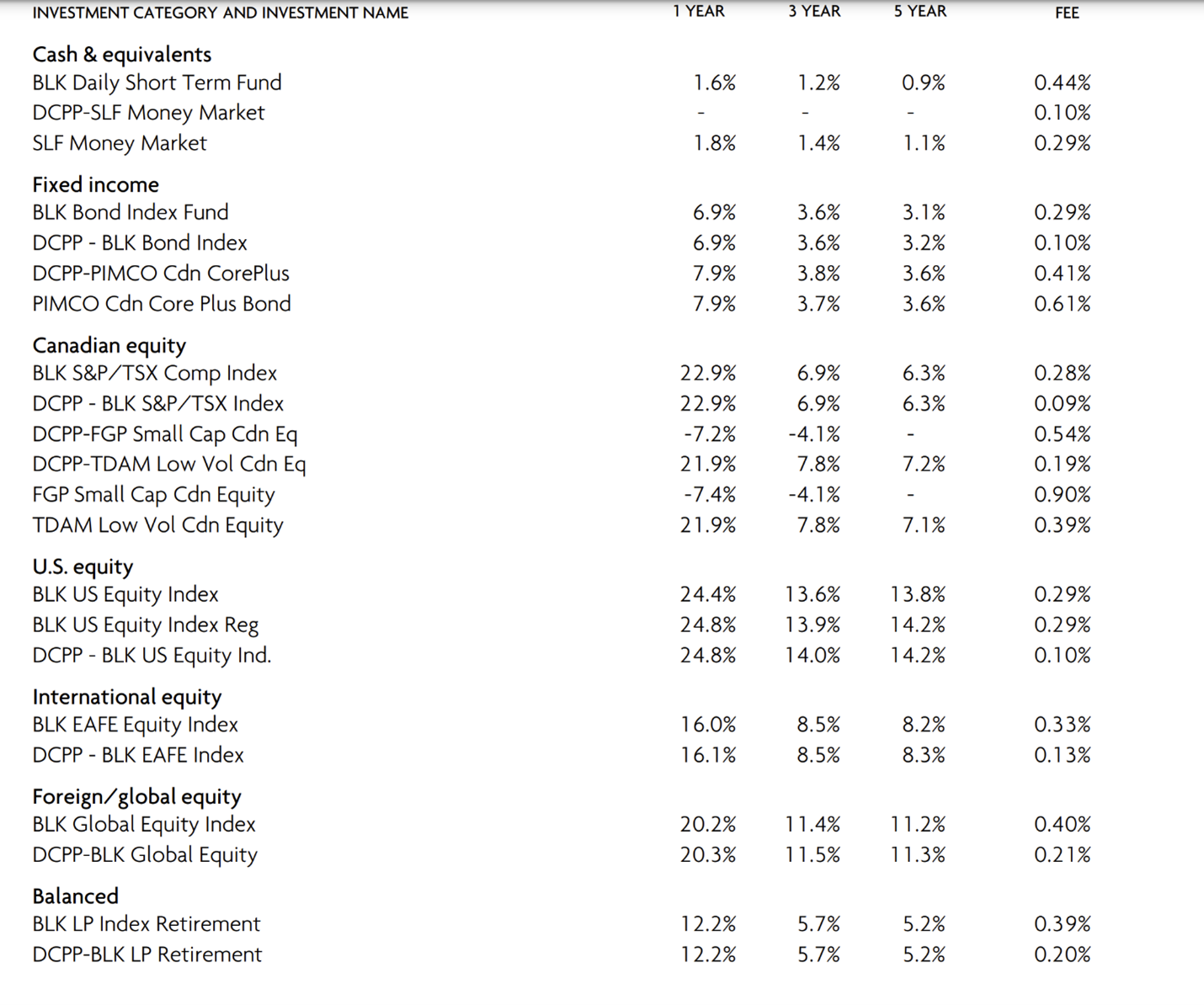

Have you ever looked at a list similar to this for your Group RRSP or DCPP and found yourself confused and wondering what the best option is?

Here’s a quick explanation of these options and how to make the best decision for yourself.

First, I’d look for “all in one” asset allocation portfolios. If a reasonably priced option is available that matches your risk profile, I would stop right there and choose that.

An asset allocation portfolio will automatically rebalance itself and be highly diversified.

Good investing is simple, and there’s no need to overcomplicate things.

In this case, they only give the option of a balanced asset allocation portfolio (60% stocks, 40% fixed-income).

If your options don’t include an asset allocation portfolio matching your risk profile or if you want to build your own for strategic reasons, here are some things to consider:

Investment Categories

Generally, the funds in each category will be highly correlated, and there’s no need to pick more than one from each category.

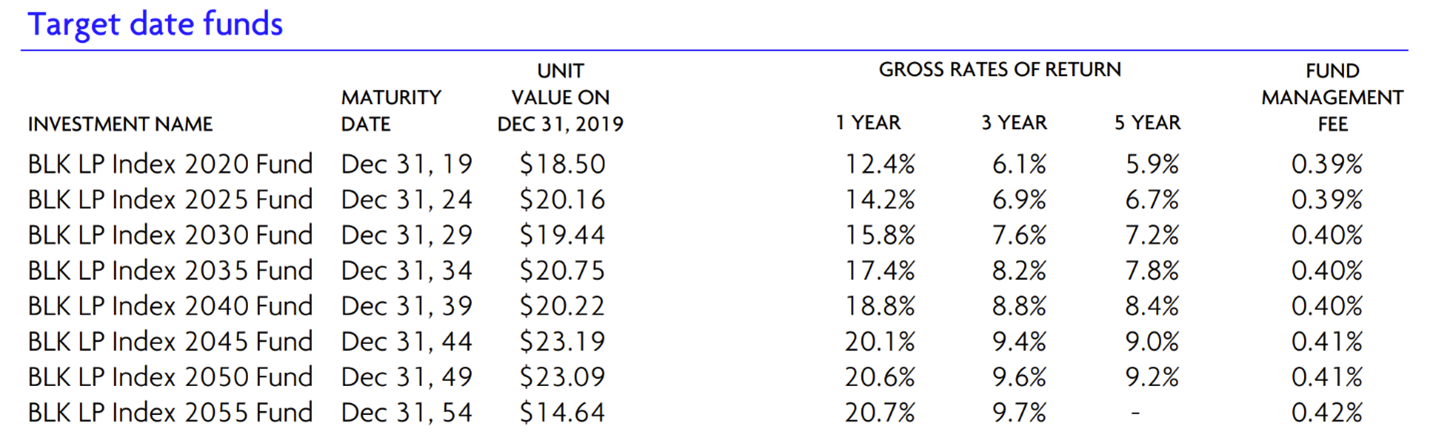

Target date funds are a unique type of asset allocation portfolio. They will be highly diversified, holding both stocks and bonds. The fund will automatically adjust its stock/fixed-income allocation as the fund year gets closer.

The higher the year (e.g., 2055), the higher the stock allocation. As the fund year gets closer, its fixed-income allocation will gradually increase.

I’m not a massive fan of target date funds as they continue to shift their asset allocation regardless of your personal risk profile.

Fund Management Fee

This shows the cost the fund manager charges for the investment.

When deciding what investment to choose, consider that all else being equal, a higher fee means a lower return to you.

You shouldn’t always just choose the lowest cost option, but keep it in mind.

Rates of Return

Don’t pick a fund based on short-term return numbers. Doing this can cause you to choose an investment that does not fit your investment timeline and/or risk profile. It can also lead to classic investor mistakes like constantly changing funds to chase performance.

The views and opinions expressed in this article may not necessarily reflect those of IPC Securities Corporation.

iSource: IBM Defined Contribution Plan Statement