Lessons from 2022

William Barreca - Feb 02, 2023

Last year was a terrible year for markets. There was almost no place to hide as bonds, stocks, crypto, and real estate all saw steep declines.

Here are some lessons that were reinforced for me last year.

- Don’t let macroeconomic predictions affect your plan

Your investment process should not be dictated by predictions about what the economy will do. The economy is incredibly complicated and dependent on so many variables that it’s impossible to predict with any degree of certainty.

Even the experts can’t predict what’s going to happen.

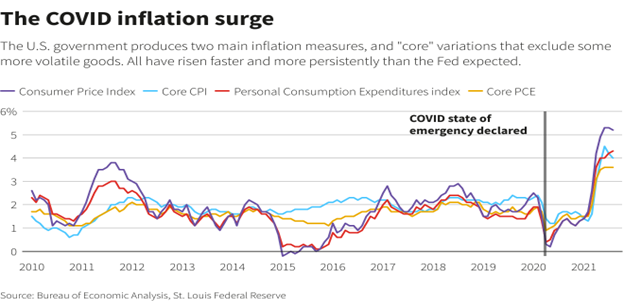

Let’s look at inflation. During the pandemic, supply chain problems and large amounts of government stimulus helped to cause inflationary pleasure.

The US Federal Reserve also played a role. At the start of the pandemic, the Fed dropped its benchmark interest rate to near zero to keep the credit market functioning. They also began large-scale purchases of Treasuries and mortgage-backed securities.

Inflation began to rise meaningfully in early 2021.

Throughout 2021, Fed officials, including Chairman Jerome Powell, maintained that this inflation was “transitory” and mainly attributed it to supply chain issues that would shortly go away.

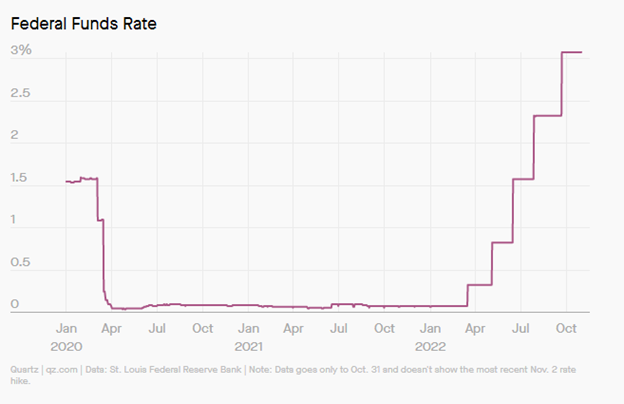

They continued keeping their benchmark interest rate near zero. Their purchases of Treasuries and mortgage-backed securities continued until March 2022.

Until all of a sudden, they realized that they were wrong and inflation wasn’t transitory. They backpedaled and began the fastest rise in interest rates since the 1980s.

The Fed got this wrong. In hindsight, they shouldn’t have kept buying securities as long as they did, and interest rate hikes should’ve begun sooner.

The point is that everything looks obvious in hindsight, but trying to make forward-looking projections about things like interest rates and inflation is impossible.

The officials at the Fed are all very smart. They have great educations and have access to huge amounts of data about the economy that isn’t publicly available. The exact data that should theoretically enable them to make accurate predictions. They still got this wrong.

Your investment process and financial plan shouldn’t be dependent on making macroeconomic predictions. It should be long-term in nature, and be able to withstand all of the surprises that will inevitably arrive.

- The stock market doesn’t always go up

Rationally, people know that the stock market doesn’t always go up. But it’s emotionally hard not to get caught up during a bull market.

Prior to 2022, there were 3 great years for the stock market.

| Year | S&P 500 Total Return |

| 2019 | +31.49% |

| 2020 | +18.40% |

| 2021 | +28.71% |

Finally, last year the S&P 500 dropped 18.11%.

This is normal and how the stock market works. Rationally, people know this, but during a prolonged bull market, it’s easy to forget that.

You should not change your risk tolerance to chase returns when the times are good.

You should also always have about 6-8 months of expenses in a cash-type investment. The same goes for any money you’re saving for short-term goals. This should not be invested in stocks or anything long-term in nature.

It’s easy to get tempted and grow frustrated having money in cash while the stock market is going up so much. But 2022 serves as a reminder of the volatility that comes with the stock market.

- The economy does not equal the stock market

Many people hesitate to invest money because of the apparent impending recession. I think one of the biggest misnomers in finance is that the stock market and the economy move simultaneously with each other.

In fact, in the short term, they can diverge wildly from each other. The stock market can perform poorly in a great economy and vice versa.

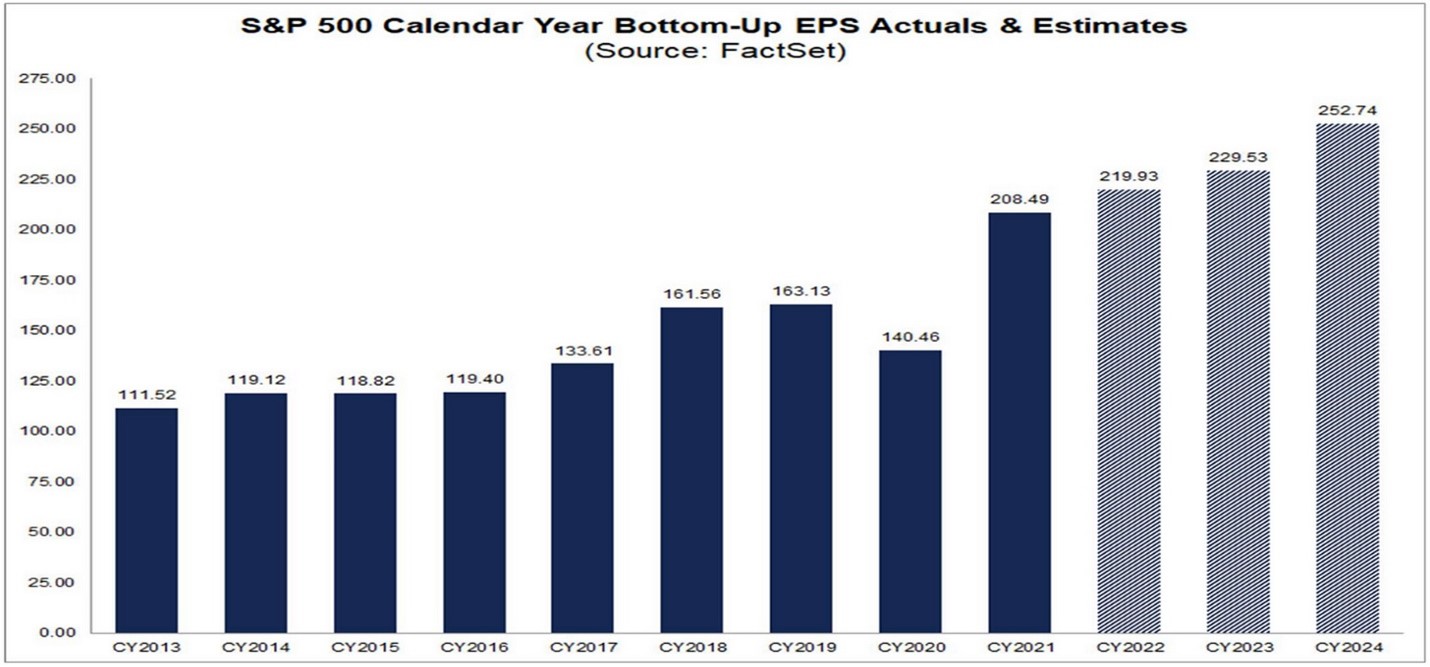

Largely due to inflation concerns, 2022 was a terrible year for the stock market. But, if you look at the data, it was actually a great year for the US economy.

The unemployment rate fell to 3.5%, below the pre-pandemic low. Overall, the US economy added 4.5 million jobs in 2022. That’s the second-strongest year on record.

On top of that, US corporations continued to grow their earnings in 2022, with estimates suggesting further growth ahead.

Considering all of this, it’s counterintuitive how bad of a year it was for the stock market.

I have no clue if there’s an impending recession or not, but it shouldn’t affect your investment decisions.

- Don’t chase performance

Recency bias is a natural human cognitive function. It’s the tendency to place too much emphasis on experiences that are freshest in your memory.

This extends to investing, where people assume that just because an investment has done really well recently, it will continue to do so.

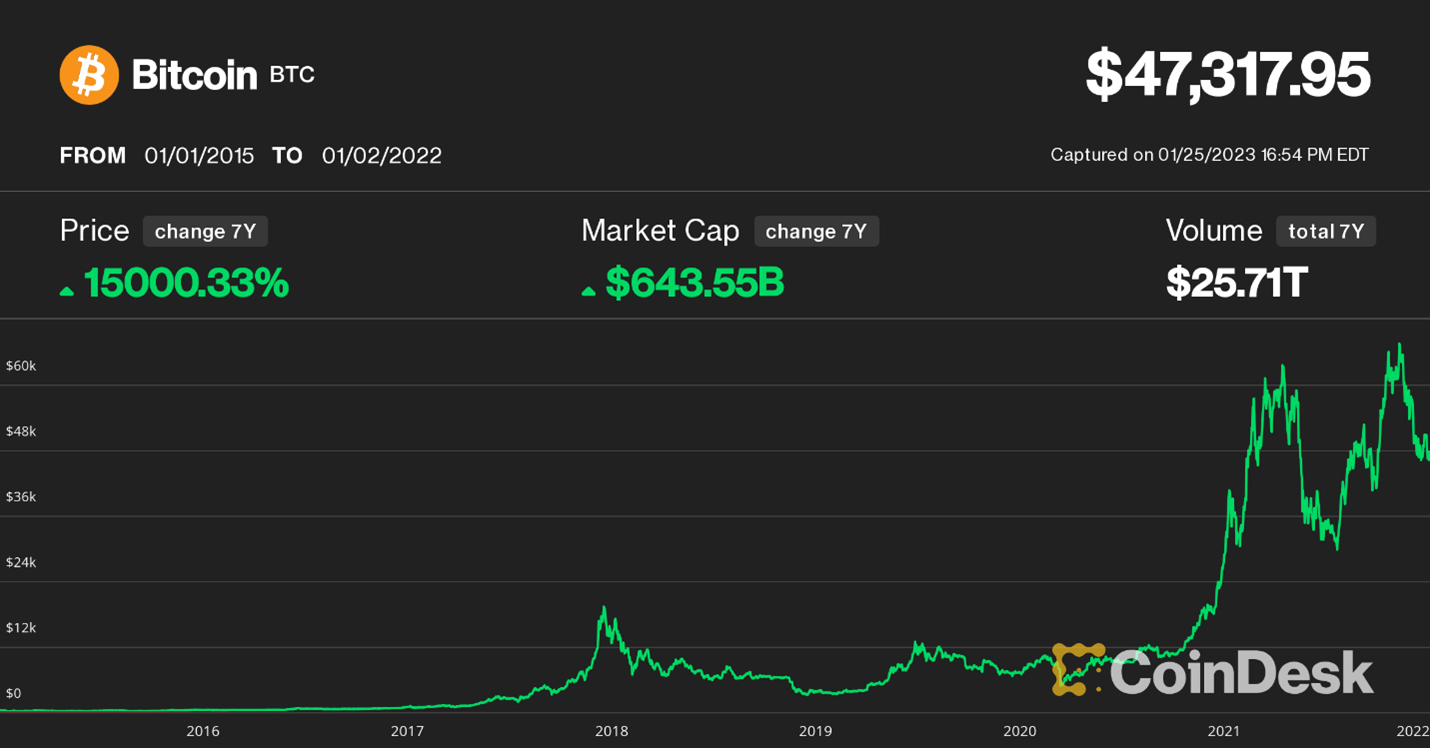

We’ve seen this play with a lot of different assets. From January 2015 to January 2022, Bitcoin rose over 15,000%

Despite this, according to a study by the Bank for International Settlements, during that same time period, roughly 3-quarters of Bitcoin investors lost money.

This is because of the tendency to buy after the price has risen and sell when it falls.

We’ve seen the same thing play out elsewhere. Whether it’s other cryptocurrencies, real estate, or technology stocks.

It’s hard but try to avoid the urge to rush into an investment just because of good recent performance. History shows that usually the exact wrong time to buy it.

The views and opinions expressed in this article may not necessarily reflect those of IPC Securities Corporation.