6 Biggest Ways People Sabotage Their Portfolio

William Barreca - Mar 14, 2025

In investing, avoiding mistakes is just as important as picking the right investment.

Here are the 6 biggest ways people sabotage their portfolios.

1. Chasing Performance

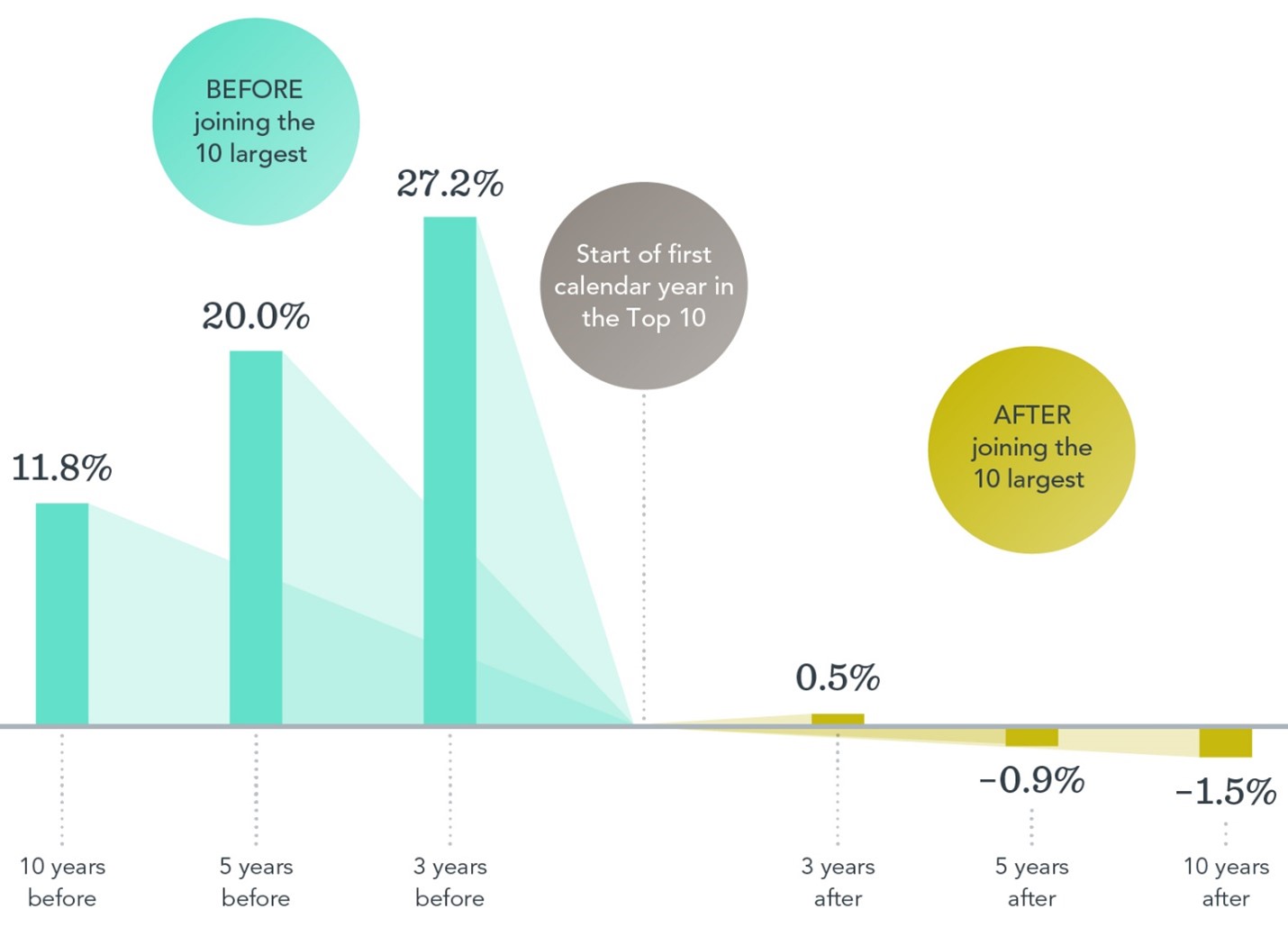

Many investors pile into the hottest stocks, funds, and ETFs after they’ve already had a strong run.

The problem? By the time you buy, the best gains are probably already behind you. Data shows that past performance is a poor predictor of future success, and funds that have outperformed in one period often struggle in the next.

Similarily, the hugely successful stocks that become some of the biggest companies in the world, statistically don’t experience that same performance forever.

[i]

[i]

2. Trying to Time the Market

It’s tempting to believe you can move in and out of the market at just the right times, avoiding downturns and capitalizing on rebounds.

But there’s no reliable way to successfully time the market. No one has a crystal ball.

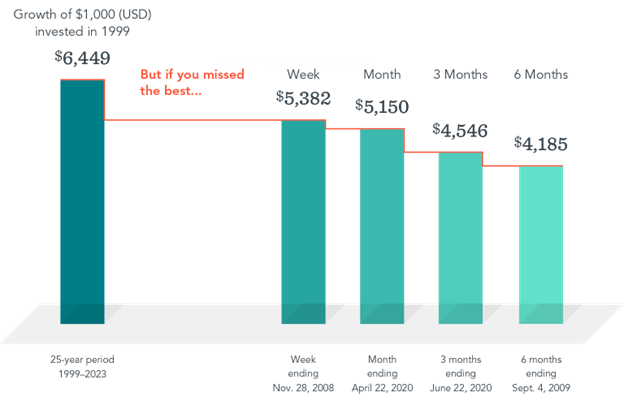

And that time you spend out of the market while waiting for that rebound can be devastating to your long-term returns.

Missing just a handful of the market’s best days can significantly impact long-term returns.

[ii]

[ii]

Your time in the market is far more impactful than timing the market.

3. Overtrading

This is counterintuitive because in almost every facet of our lives, action leads to progress.

Want to be in better shape? Work out more. Want to do better on that test? Study harder.

Investing is the complete opposite. Too much activity leads to higher transaction costs, tax inefficiencies, and the potential for emotional decision-making that works against long-term success. Studies have shown that frequent trading does lead to underperformance.[i]

Investing should not be about constant action.

4. Letting Emotions Drive Decisions

Fear and greed are two of the biggest threats to successful investing. When markets drop, panic can lead to selling at the worst possible time. When markets soar, euphoria can lead to buying the trend of the day at inflated prices.

Having a rules-based investment approach can prevent emotional decision-making. A well-diversified portfolio, combined with a disciplined rebalancing strategy, ensures you stay the course even when emotions run high.

5. Falling Prey to Short-Term Hype

There’s always a new “can’t-miss” investment trend that grabs headlines and draws in investors looking for quick gains. Whether it was the dot-com bubble, weed stocks in the late 2010s, or the NFT craze of 2020-2021, history has shown that chasing short-term hype rarely leads to long-term success.

[iii]

[iii]

Rather than chasing what’s popular today, focus on proven investment principles.

6. Letting Bad News in the Media Discourage You

Financial media thrives on dramatic headlines. Whether it’s predictions of an imminent crash or alarming reports about economic uncertainty, negative news can shake investor confidence. However, history shows that markets have endured wars, recessions, political upheavals, and other crises—yet have continued to grow over time.

Successful investors separate noise from meaningful information. Staying invested despite short-term uncertainty is the best path to long-term success.